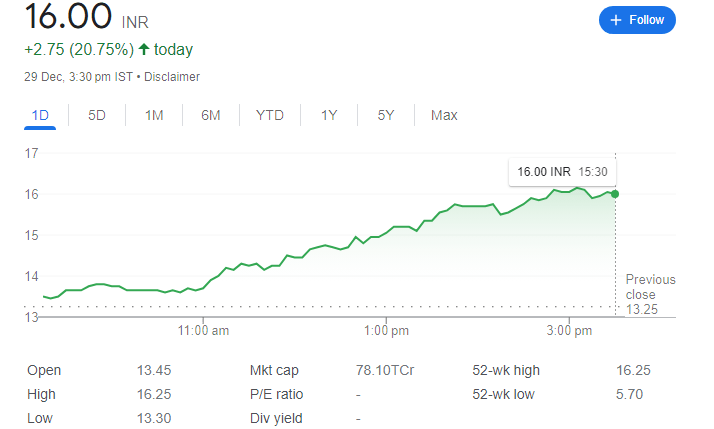

Vodafone Idea Ltd shares surged by an impressive 22.51% during the final trading session of 2023. It reaches a fresh one-year high at Rs 16.22 at 3.00 pm. This surge signifies a significant milestone for the telecom giant, which has exhibited a noteworthy year-to-date gain of over 100%.

Robust Trading Activity and Market Capitalization Boost

The trading session saw substantial activity, with an impressive 25.93 crore shares changing hands on the Bombay Stock Exchange (BSE). Far exceeding the two-week average volume of 5.28 crore shares. The resulting turnover on the counter amounted to Rs 386.63 crore, contributing to an augmented market capitalization of Rs 77,984.86 crore.

CEO’s Positive Funding Discussions Update on Vodafone Idea Ltd shares

Vodafone Idea’s CEO, Akshaya Moondra, provided a positive catalyst by indicating ongoing discussions related to funding. Moondra expressed confidence that these discussions would conclude within the current quarter, offering investors insight into the company’s strategic direction.

Technical Analysis and Trading Outlook

Technical analysts delved into the stock’s performance, identifying immediate support at the Rs 14 level and potential resistance around Rs 17. The suggested trading range for the upcoming month is projected to be between Rs 12 and Rs 20.

Bullish Trends and Investor Recommendations

Experts highlighted the stock’s bullish trends, advising investors to consider booking profits at current levels. However, cautionary notes were sounded, warning that a daily close below the support of Rs 14.9 could lead to a decline to Rs 12 in the near term.

Jigar S Patel, Senior Manager – Technical Research Analyst at Anand Rathi Shares and Stock Brokers, anticipates a support level at Rs 14 and resistance at Rs 17 for Vodafone Idea. He foresees the expected trading range to fluctuate between Rs 12 and Rs 20 over the next month.

According to AR Ramachandran from Tips2trades, Vodafone Idea displays bullish tendencies on daily charts, with the next resistance expected at Rs 16.3. Ramachandran advises investors to consider booking profits at the current levels. By emphasizing that a daily close below the support of Rs 14.9 could potentially lead to a decline to Rs 12 in the near term.

Founder of DRS Finvest, Ravi Singh, notes that the stock encounters resistance at the Rs 17 zone while highlighting major support at Rs 12. Singh’s analysis provides valuable insights for investors seeking to navigate potential price movements in Vodafone Idea’s stock.

Strong Position Against Moving Averages and RSI Analysis

Vodafone Idea observed to be trading above key moving averages, including the 5-day, 10-, 20-, 30-, 50-, 100-, 150-, and 200-day simple moving averages (SMAs). The 14-day relative strength index (RSI) stands at 72.01, indicating a potential overbought situation.

As of September 2023, promoters maintained a significant 50.36% stake in the company, providing transparency into the ownership structure.

This comprehensive analysis combines technical insights, market dynamics, and expert opinions, presenting a detailed picture of Vodafone Idea’s recent stock surge.

Disclaimer: The information provided in this article is for informational purposes only. This information should not be construed as financial or investment advice. Investors encouraged to conduct their own research and consult with qualified, certified experts before making any investment decisions.