Pradhan Mantri Mudra Yojana is a scheme launched by the PM Narendra Modi on April 8, 2015. This scheme provide upto Rs.20 Lakh loan to the non-corporate, non-farm small/micro enterprises. The scheme provide financial assistance to the the non-corporate, non-farm sector income generating activities of micro and small entities.

The micro and small entities are comprise of millions of proprietorship / partnership firms running as small manufacturing units, service sector units, shopkeepers, fruits / vegetable vendors, truck operators, food-service units, repair shops, machine operators, small industries, artisans, food processors and others.

What is Pradhan Mantri Mudra Yojana

Pradhan Mantri Mudra Yojana is a scheme where government of India provide loan for business. It is a types of business loan where small and micro entities can apply upto Rs.10 lakh loan.

Mudra stands for Micro Units Development & Refinance Agency is set up to provide loan to the non-corporate, non-farm sector income generating activities of micro and small entities.

The Loan is provided by the Government but Pradhan Mantri Mudra Yojana can be availed of from nearby branch office of a Commercial Banks, RRBs, Small Finance Banks, MFIs and NBFCs. You can also apply online through www.udyamimitra.in .

Also read: MeitY- Digital India Internship Scheme

Pradhan Mantri Mudra Yojana

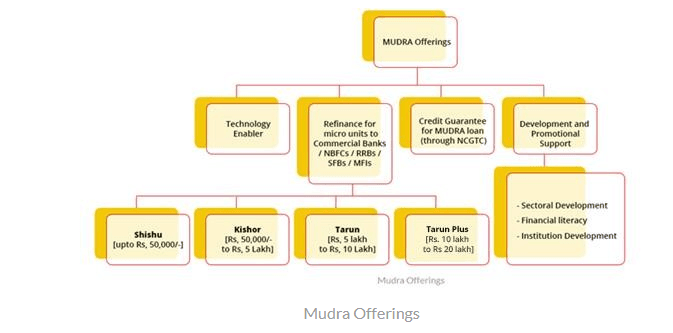

The Pradhan Mantri Mudra Yojana provided three categories of Loan they are:

1. Shishu Loan: Which covers loans Rs. 50,000

Entrepreneurs who are either in their primitive stage or require lesser funds in order to get their businesses started they can apply for this loan.

2. Kishore Loan: Which covers Above Rs. 50,000 upto Rs. 5 Lakh loan

Entrepreneurs who would belong to either those who have already started their business and want additional funds to mobilize their business they can apply for this loan.

3. Tarun Loan: Which covers Above Rs. 5,00,000 upto Rs. 10,00,000 loan

If an entrepreneur meets the required eligibility conditions, he/she could apply loan for upto Rs.10 lakhs. This would be the highest level of amount that an entrepreneur could apply for a startup loan.

4. Tarun Plus Loan: Which covers Above Rs. 10,00,000 upto Rs. 20,00,000 loan

For an entrepreneurs who have previously availed and successfully repaid loans under the ‘Tarun’ category, they can apply for the loan.

Eligibility Criteria for Pradhan Mantri Mudra Yojana

- Individuals

- Proprietary concern.

- Partnership Firm.

- Private Ltd. Company.

- Public Company.

- Any other legal forms.

1: The person applying should not owe money to any bank or financial institution and should have a good history of borrowing and repaying loans.

2: People borrowing money might need to have the right skills, experience, or knowledge for the job they want to do with the loan.

3: Whether you need to have a certain level of education depends on what you want to do with the loan and if it needs any special skills.

Document Required for PM Mudra Yojana

For Shishu Loan

- Proof of Identity – Self- attested copy of Voter’s ID Card / Driving Licence / PAN Card / Aadhaar Card / Passport / Photo IDs issued by Govt. authority etc.

- Proof of Residence: Recent telephone bill / electricity bill / property tax receipt (not older than 2 months) / Voter’s ID Card / Aadhar Card / Passport of Individual / Proprietor / Partners Bank passbook or latest account statement duly attested by Bank Officials / Domicile Certificate / Certificate issued by Govt. Authority / Local Panchayat / Municipality etc.

- Applicant’s recent coloured Photograph (2 copies) not older than 6 months.

- Quotation of Machinery / other items to be purchased.

- Name of supplier / details of machinery / price of machinery and / or items to be purchased.

- Proof of Identity / Address of the Business Enterprise – Copies of relevant Licences / Registration Certificates / Other Documents pertaining to the ownership, identity of address of business unit, if any.

For Kishore, Tarun Loan and Tarun Plus

- Proof of Identity – Self attested copy of Voter’s ID card / Driving License / PAN Card / Aadhar Card/Passport.

- Proof of Residence – Recent telephone bill, electricity bill, property tax receipt (not older than 2 months), Voter’s ID card, Aadhar Card & Passport of Proprietor/Partners/Directors.

- Applicant’s recent coloured Photograph (2 copies) not older than 6 months.

- Proof of Identity/Address of the Business Enterprise -Copies of relevant licenses/registration certificates/other documents pertaining to the ownership, identity and address of business unit.

- Applicant should not be defaulter in any Bank/Financial institution.

- Statement of accounts (for the last six months), from the existing banker, if any.

- Last two years balance sheets of the units along with income tax/sales tax return etc. (Applicable for all cases from Rs.2 Lacs and above).

- Projected balance sheets for one year in case of working capital limits and for the period of the loan in case of term loan (Applicable for all cases from Rs.2 Lacs and above).

- Sales achieved during the current financial year up to the date of submission of application.

- Project report (for the proposed project) containing details of technical & economic viability.

- Memorandum and Articles of Association of the company/Partnership Deed of Partners etc.

- In absence of third party guarantee, Asset & Liability statement from the borrower including Directors & Partners may be sought to know the net-worth.

How To apply online for Pradhan Mantri Mudra Yojana

- First do though the UdyamiMitra website or Jansamarth website.

- Select the Mudra loans and click apply now

- Another page will appear now select your category and give your name, email and mobile number to Generate OTP.

After Successful Registration

- Fill in personal details and professional details

- Select hand-holding agencies if any help is required for preparing project proposals etc., otherwise click “Loan Application Center” and apply.

- Select the category of loan required – Mudra Shishu / Mudra Kishore/ Mudra Tarun.

- The applicant then needs to fill in the Business Information like business name, business activity, etc. and select industry type like Manufacturing, Service, Trading or activities allied to agriculture.

- Fill in other information like owner details, existing Banking/ Credit facilities, proposed credit facilities, future estimates and preferred lender.

- Attach all required Documents i.e. ID proof, Address proof, Applicant photo, Applicant Signature, Proof of Identity/ Address of Business Enterprise, etc.

- Once the application is submitted, an Application Number gets generated which needs to be kept for future reference.