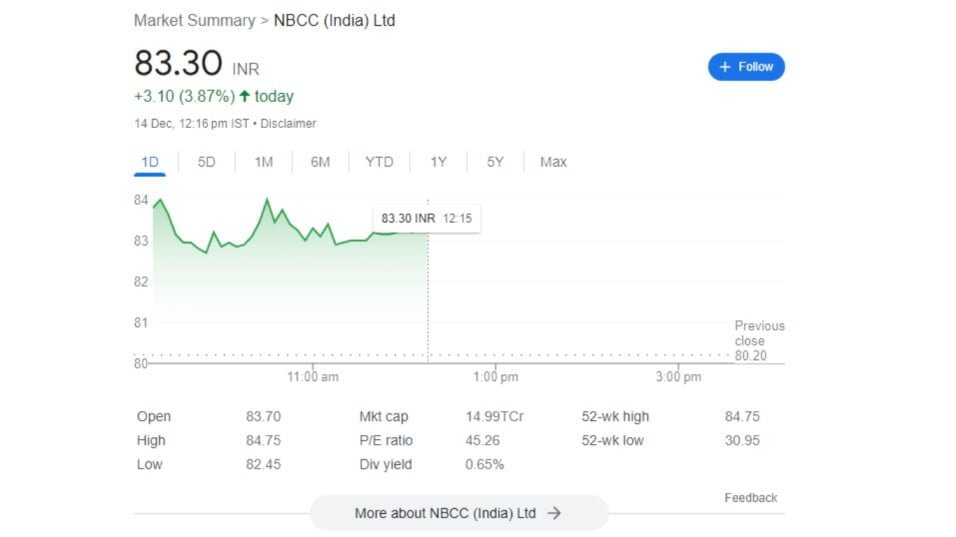

In early trade on December 14, NBCC Limited witnessed an impressive surge of nearly 6 percent, reaching a new 52-week high of Rs 84.75. This surge was fueled by the recent announcement of the company securing a significant project management consultancy contract valued at Rs 1,500 crore. The contract is geared towards the development of 1,469 warehouses and other critical infrastructure for the agriculture sector.

NBCC Project Details and Stakeholders

NBCC Secures Key Contract from NCDC and PACS for “World’s Largest Grain Storage Plan”

The contract, obtained from the National Cooperative Development Corporation (NCDC) and Primary Agriculture Cooperative Society (PACS) across various states. And also aligns with the “World’s Largest Grain Storage Plan in Cooperative Sector.” This ambitious plan, approved by the Union Cabinet in May. It aims to establish diverse agricultural infrastructures at the Primary Agricultural Credit Societies (PACS) level. These infrastructures encompass warehouses, custom hiring centers, processing units, price shops, and more, emphasizing a comprehensive ‘whole-of-Government’ approach.

Strategic Memorandum of Understanding (MoU) with ICAI

NBCC Partners with ICAI for Planning, Designing, and Execution of Building Projects

In a strategic move, NBCC Limited entered into a Memorandum of Understanding (MoU) with the Institute of Chartered Accountants of India (ICAI) in November. Under this agreement, NBCC will be responsible for the planning, designing, and execution of ICAI’s buildings and renovation works at various locations in India. This positions NBCC as the chosen entity to undertake deposit work on a turnkey basis.

NBCC Impressive 2023 Performance

NBCC’s Remarkable Surge in Shares and Financial Growth in 2023

With a market capitalization of Rs 14,427 crore, NBCC has experienced a significant surge of 97.66% in its shares in 2023. Despite reporting flat revenue growth in the September quarter, the company achieved a substantial 52% YoY increase in profit. The order book for the quarter remained flat sequentially at Rs 55,000 crore. The NBCC management has provided guidance for Rs 11,000 crore in revenues and 5-5.5% Ebitda margins for FY24.

Analyst Upgrade and Stock Performance

Nuvama Institutional Equities Upgrades NBCC Stock with Optimistic Outlook

Last month, Nuvama Institutional Equities expressed optimism about NBCC’s future prospects. Upgrading the stock from ‘HOLD’ to ‘BUY’ with a target of Rs 76 (earlier Rs 44), Nuvama cited improved order intake and margins as key factors. However, the stock closed at Rs 80.15 on Wednesday, a slight dip of 0.31% from the target.

Critical Catalyst: Realty Monetization

Real Estate Monetization as a Key Catalyst for NBCC’s Growth

Nuvama emphasized real estate monetization as a critical catalyst for NBCC’s growth. The company achieved a significant milestone by monetizing 0.39 million square feet of space in WTC Delhi for Rs 1,560 crore. This marked the highest sales realization in a single auction since the launch of WTC New Delhi in 2017. With 2.17 million square feet already monetized in the project, valued at Rs 8,750 crore, NBCC aims to complete the WTC and Amrapali projects in FY24.

Challenges and Future Outlook

Addressing Concerns and Looking Ahead: NBCC’s Book-to-Bill Ratio, Execution, and Revenue Generation

While the book-to-bill ratio of 6.2 times appears robust, concerns arise as Rs 32,000 crore worth of orders pertain to ‘self-revenue generating projects.’ The pace of real estate monetization will be crucial in determining execution. The recent success in monetizing WTC Delhi bodes well for the company’s ability to generate revenue from such projects.

Conclusion: Positioning for Potential Growth

NBCC’s Promising Future Amidst Project Wins and Positive Analyst Sentiments

In conclusion, NBCC’s recent order win, coupled with positive analyst sentiments and successful real estate monetization, positions the company for potential growth. Investors are likely to closely monitor the execution of projects. And also the pace of real estate monetization as key indicators of NBCC’s future performance.