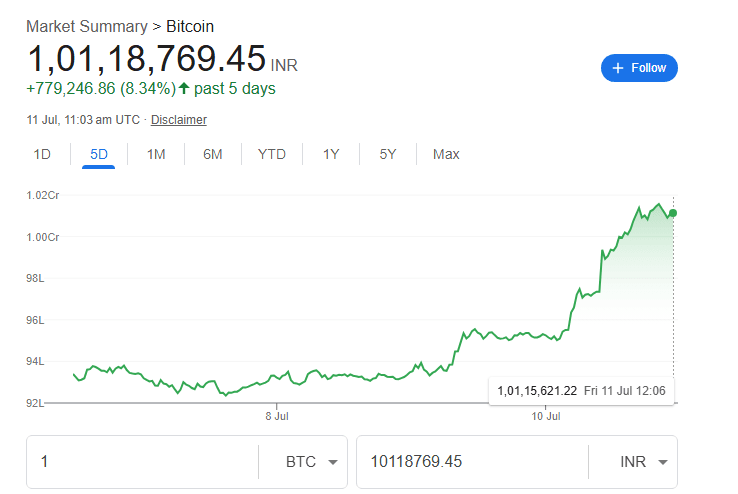

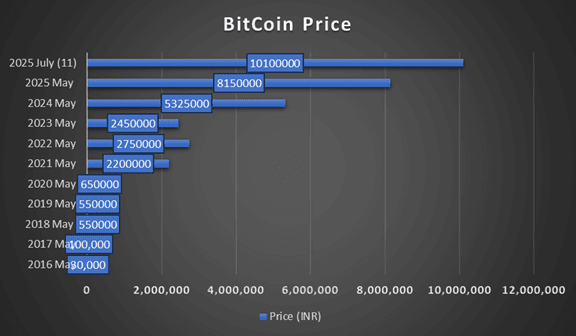

On July 11, Bitcoin has recorded all time high, trading which surpassed Rs. 1 Crore (approximately $116,000 USD), which make the history milestone in cryptocurrency market. In May, 2016 the price of the Bitcoin was just Rs 30,000, which now has skyrocketed by over 33,000% in less than a decade.

Bitcoin Growth from 2016 to July 2025

Bitcoin continues its journey with the best performance. And this July it has cross Rs.1 Crore. From under $1,000 in 2016 to now over $120,000, the digital currency has outpaced traditional investments like gold, stocks, and real estate in long-term returns.

Global Adoption and Market Trends

Bitcoin’s current rise is driven by:

Institutional purchases (BlackRock, Fidelity, etc.)

Approval of Bitcoin ETFs in the US and Europe

Impact of halving the cycle by April 2024

Growing acceptance of cryptocurrency as a viable asset class.

Retail and institutional interest is increasing in countries across continents, including the US, Canada, UK, Germany, India, Japan, Brazil, and Nigeria, amid macro factors such as inflation, geopolitical instability, and de-dollarization.

Crypto adoption varies by region

In the United States, demand is driven by ETFs and institutional investors.

India: Despite regulatory uncertainty, retail investors are adopting crypto in general.

Europe: Pro-crypto regulations promote innovation and safe trading.

In Latin America, Bitcoin is becoming a popular way to protect against inflation and currency fluctuations.

Africa is experiencing a surge in youth-driven adoption, particularly in Nigeria and Kenya.

Is Bitcoin is legal for India

Bitcoin is the most Popular among the Cryptocurrency. In July 2025 is has mark the high record as it cross Rs.1 Crore, since 2016.

Though this is not yet a prevalent practice in India, a few astute businessmen take bitcoins (rather than real currency) for the sale of goods or services.

Under the Income Tax Act, the India government accepts crypto as a virtual digital assets. So it can say that Bitcoin is legal for India. Cryptocurrency is permitted as an asset, but it is not used for everyday transactions like traditional currency. Bitcoin and Ethereum are not considered legal cash in India, hence they cannot be used to pay for goods and services on the Indian market.