The Adani-Hindenburg saga continuous from the year 2023. Again the saga came into light after on Thursday, September, 12 late night the US based short seller Hindenburg claimed that Swiss authorities have frozen more than $310 million in funds across multiple Swiss bank accounts as part of a money laundering and securities forgery investigation into Adani group, date back as early as 2021.

They stated the allegation through social media profile X formerly known as twitter. The short seller also stated, “Prosecutors detailed how an Adani frontman invested in opaque BVI/Mauritius & Bermuda funds that almost exclusively owned Adani stocks, according to newly released Swiss criminal court records reported by Swiss media outlet.”

While Adani group has firmly rejected and deny the allegation by stating, “baseless allegations”.

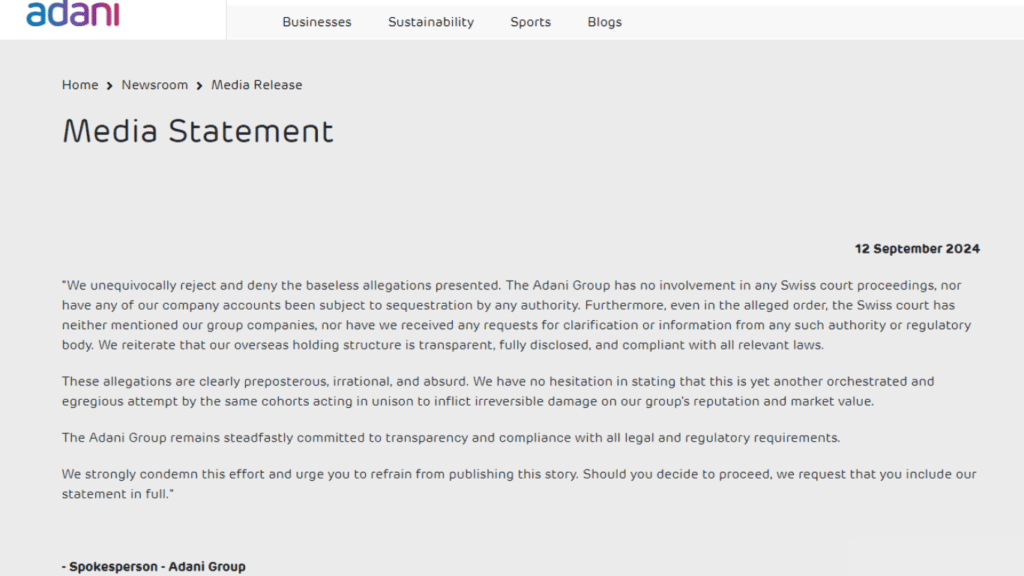

On September 12, Adani group has released a media statement. According to the spokesperson of Adani Group, “We unequivocally reject and deny the baseless allegations presented. The Adani Group has no involvement in any Swiss court proceedings, nor have any of our company accounts been subject to sequestration by any authority. Furthermore, even in the alleged order, the Swiss court has neither mentioned our group companies, nor have we received any requests for clarification or information from any such authority or regulatory body. We reiterate that our overseas holding structure is transparent, fully disclosed, and compliant with all relevant laws.

These allegations are clearly preposterous, irrational, and absurd. We have no hesitation in stating that this is yet another orchestrated and egregious attempt by the same cohorts acting in unison to inflict irreversible damage on our group’s reputation and market value.

The Adani Group remains steadfastly committed to transparency and compliance with all legal and regulatory requirements.

We strongly condemn this effort and urge you to refrain from publishing this story. Should you decide to proceed, we request that you include our statement in full.”

The First attack by Hindenburg on Adani Group

In the year 2023 January 24, Hindenburg had accused the Adani Group involved in extensive stock manipulation and accounting fraud for decades, with an estimated $218 billion involved.

The Hindenburg report claimed that since 2020, Adani Group’s chairman, Gautam Adani, increased the company’s value by $100 billion through stock price manipulation in seven major listed companies.

Hindenburg also alleged that Gautam’s younger brother, Rajesh Adani, had been arrested twice for forgery and tax fraud, but was still promoted to managing director of the group.

Additionally, the report accused Adani’s elder brother, Vinod Adani, of running 37 shell companies, which were key to the money laundering claims.

But the Adani Group has denied all the allegation.

Adani Group Shares Drop Down after the fresh allegation

After the recent allegation by Hindenburg the Adani Group shares fell down by upto 2% in early trading on Friday.