Ad

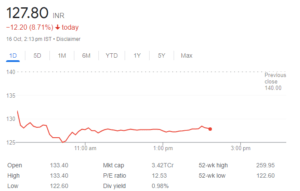

Delta Corp Ltd, a gaming and casino firm, experienced a sharp 12% decline in its shares price, reaching a one-year low at Rs 122.60 during Monday’s trading session. The plunge follows the revelation of substantial tax-related issues impacting the company’s financial standing.

Tax Troubles Escalate

Delta Corp’s subsidiary, Deltatech Gaming, recently received a notification from the Directorate General of GST Intelligence, Kolkata, indicating a substantial tax shortfall of Rs 6,384 crore. This notification further compounds the company’s existing tax shortfall obligations, which now amount to a staggering Rs 23,206 crore.

September Tax Notices

September Tax Notices

In a troubling development in September. The company served with tax notices totaling Rs 16,822 crore by the Directorate General of GST Intelligence. These notices encompassed the period from July 2017 to March 2022, with a significant demand of Rs 11,140 crore directed at Delta Corp. Additionally, another notice for Rs 5,682 crore was raised against three of its subsidiaries, namely Casino Deltin Denzong, Highstreet Cruises, and Delta Pleasure Cruises.

Market Sentiment and Analyst Insights of Delta Corp Shares Price

Amidst these tax-related challenges, market sentiment regarding Delta Corp has turned bearish. Some analysts foresee a potential further decline in the stock’s value to approximately Rs 80 in the near term, while others advise against investing in the stock at its current levels.

Technical Analysis of Delta Corp Shares Price

Delta Corp’s stock currently trades below several critical moving averages, indicating a bearish sentiment. Moreover, it is considered oversold on the daily charts, with its next support level identified at Rs 120.3. Investors are advised to exercise caution until the stock breaks the daily resistance at Rs 149 on a closing basis.

Cumulative Tax Liability

The company now grapples with a cumulative tax shortfall obligation of Rs 23,206 crore, stemming from a series of tax notifications. This has triggered substantial short selling of the stock, potentially pushing its value to lower levels, notably around Rs 80, in the weeks to come, according to experts.

Technical Metrics

Delta Corp’s stock currently trades lower than various key moving averages. Its 14-day relative strength index (RSI) stands at 18.84, well below the threshold of 30, signifying an oversold condition. In terms of valuation, the company’s stock boasts a price-to-earnings (P/E) ratio of 15.69 and a price-to-book (P/B) value of 1.64.

High Volatility and Business Segments

Delta Corp operates in the realm of casinos, with its operations encompassing real estate, gaming, hospitality, and other segments. The company’s gaming and hospitality businesses are conducted under the brand DELTIN. It owns and manages three casinos in Goa, including Deltin Royale, Deltin JAQK, and Deltin Caravela. Delta Corp carries a one-year beta of 1.34, denoting significant volatility in its stock price.

Challenging Times for Delta Corp

The significant decline in Delta Corp’s shares and its accumulating tax liabilities present formidable challenges for the company. Its require careful assessment and strategic decisions to navigate these turbulent waters.

Ad

September Tax Notices

September Tax Notices