India’s Finance Minister Nirmala Sitharaman on July 23, Today has presented the seventh consecutive Union Budget 2024-25 during Budget session 2024 in Parliament. She made a history as the first finance minister of India to present seventh consecutive budget speech.

Former Prime Minister Morarji Deshai record six consecutive budget as finance minister between 1959-64.

In this budget session finance minister has announced major reduction in customs duties on cancer drugs and mobile phones. Imported gold, silver, leather items, and seafood will all become cheaper.

Here are the key points on Budget 2024:

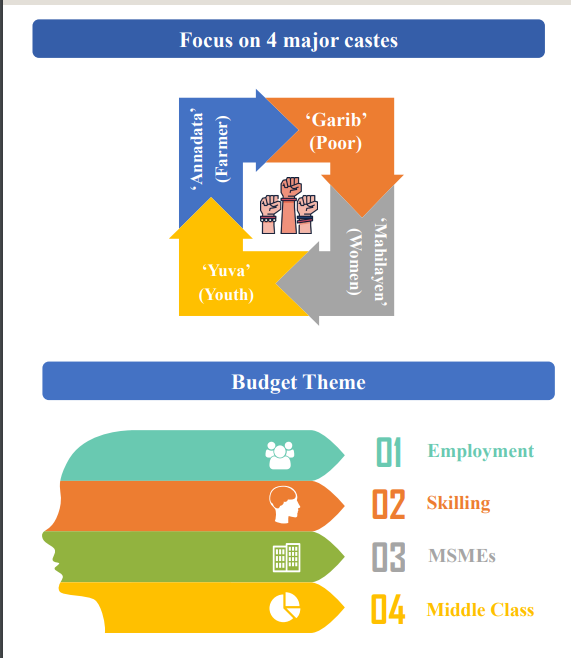

The Budget 2024-25 is focused on 4 major castes. Anandata (Farmer), Garib (poor), Mahilayen (Women) and Yuva (Youth)

The theme of the Budget are employment, skilling, MSMEs and Middle Class.

- Nirmala Sitharaman announced that Prime Minister packages with 5 schemes and initiatives to facilitate employment, skilling and other opportunities for 4.1 Crore youth over 5 years with outlay of Rs.2 Lakh crore.

- This a provision have made of Rs.1.48 lakh crores for education and employment and skilling.

- Government will provide financial support for loans upto Rs.10 lakh for higher education in country education.

- The loans will given directly to 1 lakh students every year for annual interest of 3% of loan amount.

- One month wage Upto Rs.15,000 in 3 installment to newly entering in all formal sectors will be benefited directly as registered in the EPFO.

- The eligibility will be a salary of Rs.1 lakh per month.

- This scheme expected to benefit 210 lakh youth

The Budget aims on job creation in manufacturing sector

- Nirmala Sitharaman announced a scheme to boost job creation in Manufacturing linked to first time employees.

- The scheme will offer Incentive to both employee and employer for EPFO contribution in the specified scales for the first 4 years

- The scheme expected to benefit 30 Lakh youth.

Budget 2024: To support employers

- Government will reimburse EPFO contribution of employers upto Rs.3000 per month 2 years for all new hires.

- This scheme aims to generate 50 lakh jobs

- To make the youth skilled the government aims in skilling programme

- The PM Package 4th scheme expected to skilled 20 lakh youth over a 5-years period

- 1000 Industrial training programme will be upgraded in hub and spoke arrangement with outcome orientation.

- Course content & design aligned as per skill needs of industry.

Budget 2024: To empower the government has taken many steps

- To Facilitate higher participation of women in the workforce so government is setting up of working women hostels in collaboration with industry, and establishing creches.

- Allocation of more than ₹3 lakh crore for schemes benefitting women and girls.

- Encouraging states to lower stamp duties for properties purchased by women.

Internship Opportunities by Government

- Government has made Internship Opportunities for providing internship opportunities in 500 top companies to 1 crore youth in 5 years.

- An allowance of ₹5,000 per month along with a one-time assistance of ₹6,000 will be given through the CSR funds.

Budget 2024: Urban Development

- Under PM Awas Yojana Urban 2.0 housing Needs of 1 crore urban poor and middle-class families will be addressed with an investment of ₹10 lakh crore.

- To Promote water supply, sewage treatment and solid waste management projects and services for 100 large cities through bankable projects.

- The government Envisioning a scheme to develop 100 weekly ‘haats’ or street food hubs in select cities

Under PM Surya Ghar Muft Bijli Yojana

- 1 crore Households obtain free electricity Up to 300 Units every month. 1.28 crore Registrations and 14 lakh applications so far.

Flood management:

- The government will provide support for flood management and related projects in Assam, Sikkim & Uttarakhand.

- Financial support for projects with estimated cost of ₹11,500 crore such as the Kosi-Mechi intra-state link and 20 other ongoing and new schemes.

- Assistance for reconstruction and rehabilitation in Himachal Pradesh

Budget 2024:Agricultura and Rural Development

- Comprehensive review of the agriculture research setup to bring focus on raising productivity and developing climate resilient varieties.

- 1 crore farmers across the country will be initiated into natural farming, supported by certification and branding in next 2 years.

- Financing for Shrimp farming, processing and export will be facilitated through NABARD.

- Issuance of Jan Samarth based Kisan Credit Cards

- More than 100 branches of India Post Payment Bank will be set up in the North East region.

Infrastructure development:

- ₹1.5 lakh crore to states as longterm interest free loans to support resource allocation.

- Phase IV of PRADHAN MANTRI GRAM SADAK YOJANA (PMGSY) will be launched to provide allweather connectivity to 25,000 rural habitations.

Tourism Development:

- Development of Vishnupad Temple Corridor and Mahabodhi Temple Corridor modelled on Kashi Vishwanath Temple Corridor

- Comprehensive development initiative for Rajgir will be undertaken which holds religious significance for Hindus, Buddhists and Jains.

- The development of Nalanda as a tourist centre besides reviving Nalanda University to its glorious stature.

- Assistance to development of Odisha’s scenic beauty, temples, monuments, craftsmanship, wildlife sanctuaries, natural landscapes and pristine beaches making it an ultimate tourism destination.

Changes in Custom Duty

- Fully exempt 3 more cancer medicines from custom duties

- Reduce BCD to 15% on Mobile phone, Mobile PCBA and charger

- Reduce custom duty on gold and silver to 6% and platinum to 6.4%

- Reduce BCD on shrimp and fish feed to 5%

Revised Tax Rate Under New Tax Regime:

- ₹0-3 lakh – nil tax

- ₹3-7 lakh – 5%

- ₹7-10 lakh – 10%

- ₹10-12 lakh – 15%

- ₹12-15 lakh – 20%

- Above ₹15 lakh – 30%