Ad

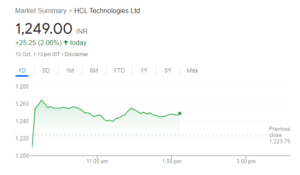

Stock Surges Over 2% in Early Trading

HCL Share Price: HCL Technologies, India’s third-largest IT services company, released its second-quarter results for FY24, leading to a notable surge in its stock price. Here’s a comprehensive overview of the key highlights and assessments from various brokerages:

HCL Share Price Impressive Q2FY24 Results

HCL Technologies reported impressive results for the second quarter of FY24:

- Robust Profit Growth: The company achieved a remarkable 8.55% quarter-on-quarter (QoQ) increase in net profit for Q2FY24, reaching ₹3,833 crore.

- Consolidated Revenue Growth: HCL Technologies recorded a solid 1.4% QoQ growth in consolidated revenue for the quarter, amounting to ₹26,672 crore.

- Constant Currency (CC) Growth: In constant currency (CC) terms, the revenue exhibited a 1% QoQ increase.

Dividend Declaration

Dividend Declaration

HCL Technologies also declared an interim dividend of ₹12 per equity share with a face value of ₹2 each for the fiscal year 2023-24, providing a return to its shareholders.

Brokerages’ Insights on HCL Technologies

Let’s explore the opinions and insights from various brokerage firms regarding HCL Technologies’ Q2 results and its stock performance:

Morgan Stanley

Morgan Stanley acknowledged the reduction in revenue guidance by HCL Technologies but considered it largely anticipated. The key focus for investors is the company’s ability to outperform in the second half (H2) in comparison to the muted outlook shared by peers. The brokerage maintains an ‘Overweight’ rating on the stock and has adjusted the target price to ₹1,400 per share from ₹1,450.

Kotak Institutional Equities

Kotak Institutional Equities noted that HCL Technologies reported muted yet in-line revenue growth. The company’s EBIT margin significantly surpassed their estimates. As anticipated, HCL Technologies reduced its FY2024E organic revenue growth guidance from 6-8% to 4-5%. The revised guidance, even at the upper end of the band, is seen as somewhat aggressive. Kotak Institutional Equities maintains a ‘Buy’ rating on the stock with an unchanged target price of ₹1,410 per share.

Motilal Oswal

Motilal Oswal, a brokerage firm, acknowledged that HCL Technologies reported a weak Q2FY24 but highlighted that the stock’s valuations offer a margin of safety. The company’s higher exposure to Cloud services, a sector with a substantial share of non-discretionary spending, positions it for better resilience amid increased demand for Cloud, Network, Security, and Digital Workplace services. Motilal Oswal reaffirms its ‘Buy’ rating on the stock with a target price of ₹1,410 per share.

JM Financial

JM Financial stated that HCL Technologies’ Q2 results align with expectations and the guidance cut was as anticipated. The brokerage now expects HCL Technologies to achieve 4.6% organic growth and 5.7% reported USD revenue growth for FY24, falling within the guided range. To reflect this, they slightly adjusted their valuation, now valuing the stock at 18x forward EPS (up from 16x earlier), while maintaining a 10% discount compared to Infosys’ target multiple. JM Financial maintains a ‘Hold’ rating on the stock while raising the target price to ₹1,250 per share from ₹1,070.

Antique Stock Broking on HCL Share Price

Antique Stock Broking observed that HCL Technologies’ results fell short of revenue expectations, despite the EBIT margin outperforming estimates. Nevertheless, the new guidance from HCL Technologies suggests robust organic growth of 2.7%-4.0% Compound Quarterly Growth Rate (CQGR) in the second half of the year, enhancing the visibility of achieving industry-leading growth in FY25. Antique Stock Broking maintains its ‘Buy’ rating with a target price of ₹1,475 per share.

Sharekhan

Sharekhan recognized HCL Technologies’ healthy Q2FY24 numbers, with in-line CC revenue growth of 1% QoQ and a notable beat of 78 basis points in the EBIT margin, which reached 18.5%. The revised revenue growth guidance indicates expectations of 3.3-4.5% Compound Quarterly Growth Rate (CQGR) for Q3/Q4 of FY24. Sharekhan estimates a healthy revenue and Profit After Tax (PAT) Compound Annual Growth Rate (CAGR) of 8% and 9%, respectively, over the period spanning FY23-26. Consequently, Sharekhan maintains a ‘Buy’ recommendation and raises the target price to ₹1,400 per share.

Stock Performance of HCL Share Price

As of 9:20 am, HCL Technologies’ share price traded 2.32% higher at ₹1,252.40 per share on the BSE. It is reflecting the positive response to the company’s robust performance in Q2FY24.

Ad

Dividend Declaration

Dividend Declaration