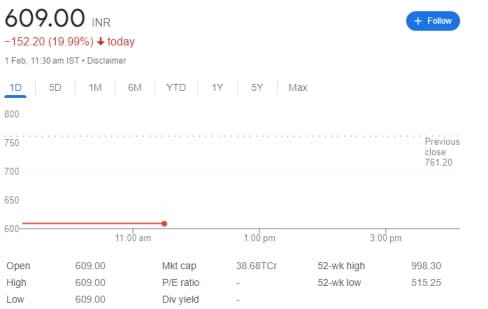

Paytm ‘s stock witnessed a sharp decline of 20 percent in early trade on February 1. After the Reserve Bank of India (RBI) has imposed major restrictions on the fintech giant’s lending business. The measures include a ban on accepting fresh deposits and conducting credit transactions after February 29.

Paytm Shares Crash

The opening bell saw Paytm’s stock hit the lower circuit, trading at Rs 609 per share, marking a 20 percent drop on the NSE compared to the previous day’s closing price of Rs 761 on January 31. Year-to-date, the stock has experienced a 1 percent decline, and in 2023, it suffered a significant loss of 27.45 percent.

As of the December 2023 quarter, mutual funds held a 5 percent stake in Paytm, up from 2.79 percent in the previous quarter. This shift in ownership dynamics reflects the changing sentiment towards the company.

Also read: Reliance Share Price hit a high record

RBI’s Concerns and Drastic Action

The RBI cited a validation report from external auditors revealing “persistent non-compliances and continued material supervisory concerns” in Paytm Payments Bank. These concerns prompted the RBI to take stringent actions, impacting Paytm’s ability to engage in certain financial activities.

Paytm’s Response and Immediate Steps

In response to the RBI’s measures, Paytm assured the exchanges that it is taking immediate steps to comply with the regulator’s directions. The company committed to addressing the concerns swiftly. Paytm acknowledged the potential worst-case impact on its annual EBITDA, estimating it to be between Rs 300-500 crore. Despite this setback, the company remains optimistic about improving its profitability.

Paytm Founder’s Position and Downgrade by Jefferies

Vijay Shekhar Sharma, Paytm’s founder and largest shareholder, confirmed that he has not taken any margin loans or pledged any shares directly or indirectly owned by him. In August 2023, Sharma increased his stake to 19.42 percent by acquiring a 10 percent stake from AntFin through his overseas entity, Resilient Asset Management BV.

However, the challenging situation led brokerage firm Jefferies to downgrade Paytm from a ‘buy’ to ‘underperform’. Furthermore, Jefferies slashed the stock’s price target by over half, setting it at Rs 500. This downgrade reflects a downside potential of more than 34 percent for Paytm’s stock. Jefferies anticipates significant reputational risks for Paytm in the aftermath of the RBI’s actions.

Outlook and Road Ahead for Paytm

Despite the hurdles, Paytm remains focused on resolving regulatory concerns and improving its profitability trajectory. The company is actively collaborating with the regulator to navigate the challenges posed by the RBI’s restrictions. As the situation unfolds, Paytm will strive to regain market confidence and address the reputational risks associated with the regulatory scrutiny.

The Key Restrictions Imposed by RBI that Paytm customers should know

- Account Limitations After February 29, 2024:No additional deposits, credit transactions, or top-ups allowed in customer accounts, including wallets, FASTags, NCMC cards, etc.

Exceptions for interest, cashbacks, or refunds credited anytime.

Withdrawals and balance utilization permitted without restrictions, up to the available balance. - Ban Banking Services After February 29, 2024:Only withdrawals and utilization allowed; no other banking services like fund transfers (AEPS, IMPS, etc.), BBPOU, and UPI after the specified date.

- Termination of Nodal Accounts: Nodal Accounts of One97 Communications Ltd and Paytm Payments Services Ltd. to be terminated by February 29, 2024.

- Pipeline Transaction Settlement Deadline: Settlement of all pending pipeline transactions and nodal accounts initiated on or before February 29, 2024, to be completed by March 15, 2024.

No further transactions permitted beyond this date. - IHMCL’s Previous Action:Indian Highways Management Company (IHMCL) had earlier barred Paytm Payments Bank from issuing new FASTags due to non-compliance with prescribed parameters in the service-level agreement.

Gaurav Goel’s Insights:

Gaurav Goel, Founder-Director of Fynocrat Technologies, highlights RBI’s measures against Paytm Payments Bank.

RBI’s concerns revolve around ongoing non-compliance and supervisory issues, raising questions about the operational integrity of Paytm Payments Bank.

Current restrictions mainly affect Paytm’s banking operations. Customers can still use Paytm for digital payments as long as their accounts are linked to an external bank.

The impact on Paytm’s existing customers significant, and the company’s official statement awaited.

Short to medium-term stock prices of Paytm (One 97 Communication) are expected to be influenced by these developments.

In conclusion, Paytm finds itself at a crucial juncture, navigating regulatory challenges that have substantially impacted its stock performance. The coming days will reveal the efficacy of Paytm’s efforts to comply with the RBI’s directives and its ability to regain investor trust.

Disclaimer: The information provided in this article is for informational purposes only. This information should not be construed as financial or investment advice. Investors encouraged to conduct their own research and consult with qualified, certified experts before making any investment decisions.