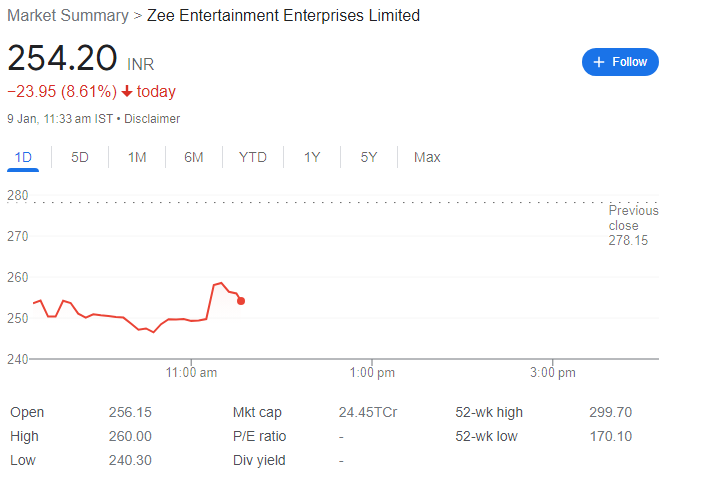

Shares of Zee Entertainment Enterprises Ltd (ZEEL) experienced a significant dip, dropping by up to 10% to a day’s low of Rs.249.75 on the Bombay Stock Exchange (BSE) on Tuesday.

The decline in ZEEL’s stock value follows reports from Bloomberg. Suggesting that Sony Group Corp is on the verge of abandoning the much-anticipated $10 billion merger. The prolonged two-year wait may come to an end due to regulatory challenges faced by Zee Entertainment’s Managing Director, Punit Goenka.

Zee Entertainment Regulatory Quagmire

Sony is reportedly contemplating formally notifying Zee about terminating the merger by the end of the month, possibly as early as January 22nd. The primary obstacle has been the regulatory challenges surrounding Punit Goenka, with Invesco, Zee’s largest public shareholder. Expressing dissent and insolvency proceedings initiated against the Essel group.

SEBI’s Directive Adds Complexity

Despite overcoming various challenges and obtaining necessary regulatory approvals, a directive from the Securities and Exchange Board of India (SEBI) last year disrupted the momentum. SEBI’s order barring Goenka from holding executive or directorial positions added a new layer of complexity. This directive, which came after SEBI overturned its own decision in October of the preceding year. Which contributed to uncertainties surrounding

Goenka’s role in the merged entity of Zee Entertainment and Sony.

Deadline Extension and Ongoing Regulatory Investigation

Zee sought an extension from Sony, citing critical unresolved issues, including the matter of Goenka heading the merged entity. The anticipation for the merger’s completion by the stipulated deadline of December 21, 2023, was high. However, Sony’s unease with Goenka leading the merged company, especially during an ongoing regulatory investigation, has led to delays in finalizing the deal.

Potential Impact on Sony and Zee

The setback is poised to impact both Sony and Zee adversely. Particularly given their reported subpar growth over the past year. Emkay Global highlighted a potential lose-lose scenario for both parties in the face of competition from the much larger Reliance-Disney entity if the merger were to materialize. The collapse of the deal is seen as strategically detrimental to both companies.

Conclusion

As Sony weighs the decision to abandon the merger with Zee Entertainment. So, the market remains on edge, closely monitoring developments that could have lasting repercussions for both companies. The regulatory complexities surrounding Punit Goenka and the potential competitive challenges from other industry players further contribute to the uncertainty surrounding the fate of this highly-anticipated $10 billion deal.