Impressive Listing Premium of RR Kabel Share price

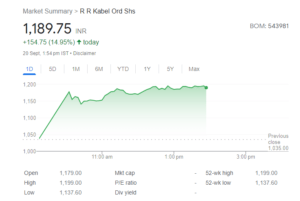

In a noteworthy debut, RR Kabel shares exceeded expectations, boasting a substantial 14% premium compared to the issue price range of ₹983 to ₹1,035 per equity share. The stock made a strong entry on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), opening at ₹1,179 and ₹1,180 per share, respectively.

Market Surpasses Predictions

This premium listing surpassed earlier forecasts by both grey market enthusiasts and stock market experts, who had predicted a more modest 8-10% listing premium for investors. Post-listing, RR Kabel’s share price soared further, reaching an intraday peak of ₹1,198 on NSE and ₹1,198.05 on BSE.

Profit Booking Sets In RR Kabel Share price

Profit Booking Sets In RR Kabel Share price

Despite its initial surge, profit booking eventually ensued, causing the stock to retreat to ₹1,143.10 on BSE and ₹1,136.80 on NSE.

Valuation Concerns and Advice

Market experts have raised concerns regarding RR Kabel Ltd’s elevated valuations. The company’s price-to-earnings (PE) multiple exceeds that of its peers, primarily due to its lower profit margins. Consequently, experts recommend shareholders to consider booking listing profits and explore alternative investments within the same industry.

Expert Guidance on RR Kabel Share price

Arun Kejriwal, Founder at Kejriwal Research and Investment Services, advises RR Kabel shareholders to consider seizing the opportunity to book listing profits. He highlights that approximately 90% of the IPO’s net proceeds were reserved for an Offer for Sale (OFS), primarily benefiting the promoters. As a result, the public issue is not expected to have a significant impact on the company’s financials, potentially maintaining its higher valuations compared to its peers.

Prashanth Tapse, Senior Vice President — Research at Mehta Equities, echoes Kejriwal’s sentiments. He acknowledges that RR Kabel’s IPO was launched with higher valuations, reflecting the current market scenario. Tapse suggests that following the better-than-expected premium listing, RR Kabel shareholders should consider booking profits and exiting. He anticipates that competitors like KEI and Polycab are likely to outperform RR Kabel in the near future. For those who missed out on RR Kabel shares during the allotment process, Tapse advises against fresh investments at current levels, recommending exploration of other public issues or alternative investment opportunities within the same industry.

RR Kabel IPO Overview

The RR Kabel IPO, positioned at the upper end of the price band, aimed to raise ₹1,964.01 crore. The IPO comprised a ₹180 crore fresh issue of equity shares and an offer for sale (OFS) of 1.72 crore equity shares worth ₹1,784 crore by the promoters and investors. Within the OFS, TPG Asia VII SF Pte Ltd divested 1.29 crore equity shares, while the public shareholder Ram Ratna Wires sold its entire shareholding of 13.64 lakh shares.

Profit Booking Sets In RR Kabel Share price

Profit Booking Sets In RR Kabel Share price