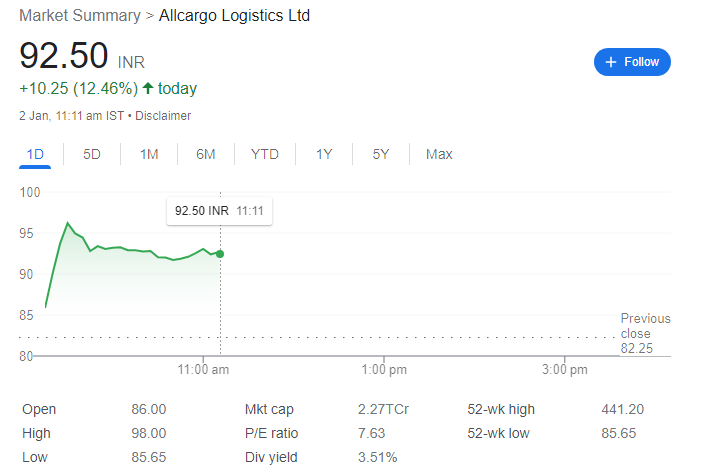

Allcargo Logistics is in the trending as its shares commence trading ex-bonus today. The Board of Directors, in a meeting held on November 10, 2023, declared a bonus issue in the ratio of 3:1. Which demonstrates the company’s commitment to enhancing shareholder value. Subsequently, the board fixed January 2, 2024, as the record date to determine eligible shareholders for the issuance of bonus shares.

Allcargo Logistics Background and Bonus Share Declaration

Allcargo Logistics, a prominent player in the logistics sector, disclosed the bonus share issuance in compliance with Regulation 30 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015. The company informed the Indian stock market exchanges about this decision, emphasizing the importance of adhering to regulatory guidelines.

The company stated, “With reference to our letters dated November 03, 2023, and November 7, 2023,” the Board of Directors, during its meeting on November 10, 2023, approved the issuance of bonus shares. The bonus shares are to be capitalized from the sum standing to the credit of Free Reserves of the Company, not exceeding ₹147,41,73,144. This amount is as per the audited financial statements of the company for the financial year ended March 31, 2023.

The approved sum is to be transferred to the Share Capital Account and utilized for the issue and allotment of equity shares. The bonus shares, totaling 73,70,86,572 equity shares of ₹2 each, will issue as fully paid-up bonus shares. Eligible members of the company, holding equity shares of ₹2 each, will receive 3 new equity shares of ₹2 each for every 1 existing equity share held as on the Record Date.

Allcargo Logistics Record Date Fixation for Bonus Shares

Following the board’s decision, Allcargo Logistics promptly informed shareholders and the stock market about the fixation of the Record Date through a regulatory filing. In accordance with Regulation 42 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, the company stated that the Board of Directors had fixed Tuesday, January 2, 2024, as the Record Date.

The Record Date holds significance as it determines the eligibility of shareholders for the allotment of bonus shares in the stipulated 3:1 ratio. Allcargo Logistics emphasized that this allotment is subject to the approval of shareholders, to be obtained through a postal ballot conducted via the e-voting process.

Bonus Share History and Second Ex-Bonus Trading Instance

This development marks the second time Allcargo Logistics shares are trading ex-bonus. The previous instance occurred on December 30, 2015, when the logistics giant issued bonus shares in a 1:1 ratio. The decision to undertake a bonus issue once again reflects the company’s strategic approach to rewarding its shareholders and reinforcing its commitment to sustained growth.

Strategic Significance and Shareholder Value Enhancement

The issuance of bonus shares is a strategic move that serves multiple purposes. It not only rewards existing shareholders but also acts as a demonstration of the company’s confidence in its financial health and future prospects. By capitalizing on the Free Reserves, Allcargo Logistics aims to fortify its capital structure while providing shareholders with an increased stake in the company.

This shareholder-centric approach aligns with the company’s broader vision and commitment to fostering long-term relationships with its investors. Allcargo Logistics, by opting for a 3:1 bonus share issuance, is sending a positive signal to the market, showcasing its optimism about the company’s performance and its ability to generate sustained value for shareholders.

In conclusion, as Allcargo Logistics enters the ex-bonus trading phase, shareholders eagerly await the bonus share allotment. The company’s strategic decisions, coupled with its transparent communication and adherence to regulatory frameworks, contribute to its reputation as a reliable and shareholder-friendly entity in the dynamic landscape of the Indian stock market.