Ad

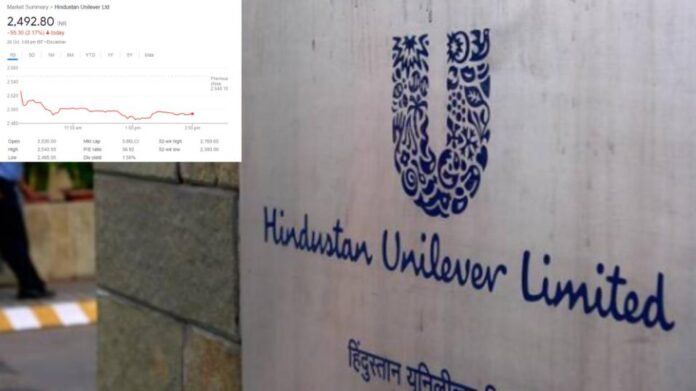

In the second quarter, Hindustan Unilever Ltd (HUL) experienced challenges in terms of volume growth, attributed to increased competition and weak rural demand. However, declining raw material prices supported the company’s margins. HUL Share Price declined by 2% in morning trades.

HUL Share Price result

HUL’s results for the September quarter revealed the positive impact of lower input cost inflation. Gross margins improved, and Ebitda margins increased by 130 basis points year-on-year, reaching 24.6%. However, revenue and volume growth were modest at 4% and 2%, respectively. HUL’s profits before exceptional items increased by 12% year-on-year, amounting to ₹2,668 crore.

Analysts’ Views on HUL Share Price

Analysts’ Views on HUL Share Price

- Jefferies India Pvt Ltd analysts noted the challenges in HUL’s performance, including increased competitive activity and trailing industry growth. They expressed cautious optimism, anticipating that the stock price would remain range-bound after uninspiring results. They lowered Earnings per Share (EPS) estimates for FY24 and FY25 and adjusted the price target slightly downward.

- Amnish Aggarwal, Head of Research at Prabhudas Lilladher Pvt Ltd, rated HUL as a “Hold.” He highlighted that the stock traded at 50.2 times FY25 earnings estimates and expressed the view that volume recovery would be gradual. He expected a potential upswing in 3Q24 due to the festive season, sustained services buoyancy, and government investment. Aggarwal cautioned that commodity inflation could impact gross margins and Ebitda margin recovery.

- Antique Stock Broking analysts also recommended a “Hold” on HUL’s stock. They acknowledged the challenging quarter, describing it as one of the weakest in recent quarters across FMCG companies. They anticipated varying performance among FMCG players, with some experiencing a re-rating.

ITC’s Q2 Performance

ITC Ltd faced challenges and a high base in its Q2 performance but remained steadier, according to analysts. Cigarette net sales and Ebit grew by 8.5% and 8%, with a 5% volume growth on a high base. ITC’s Hotels Business had a stellar second quarter performance, contributing to the company’s overall Q2 performance. The paper boards segment and agri-related businesses, however, experienced weakness.

ITC’s FMCG Businesses segment revenue grew by 8.3% YoY, surpassing HUL, although it was lower compared to ITC’s 2-year CAGR of over 14.5%. Segment Ebitda margins expanded by 150 basis points YoY to 11%.

Analysts’ Views and Recommendations for ITC

- Jefferies India Pvt Ltd analysts pointed out that ITC’s 2Q marked the first quarter of MSD Ebitda growth after nine quarters of DD growth. Cigarette volume growth moderated to a multi-quarter low but was still impressive compared to FMCG peers. The earnings miss was attributed to paperboards, which were expected to improve. They found ITC’s valuation at 25x P/E to be reasonable in a sector with a premium.

- Antique Stock Broking analysts remained positive about ITC, emphasizing its steady momentum in the cigarette business, FMCG, and Hotel business performance. They maintained a “Buy” recommendation and adjusted their target price based on a Sum-of-the-Parts valuation to ₹510, implying a price-to-earnings ratio of 25 times.

- Aggarwal of Prabhudas Lilladher expected cigarette volume growth to moderate to 4-5% in H2FY24. He anticipated gains in the FMCG business due to the festive season and increased rural demand. He also expected margin improvement in the Paper and Paperboard business in the coming quarters. Aggarwal believed that strong growth in Hotels and FMCG would continue due to favorable input costs and robust demand outlook for both domestic and foreign travel. His target price, based on the sum of the parts, was ₹492, higher than the previous target of ₹475.

Ad

Analysts’ Views on HUL Share Price

Analysts’ Views on HUL Share Price